TGIFF #005: Why You Want to Be Naked

Jun 05, 2023

Let me start off with an undeniable fact - Most forex traders lose out.

Now there are a lot of reasons for this, here are 2 very common reasons why the failure rate is over 90%.

And they can be boiled down to these 2 misconceptions about successful trading:

- Misconception #1: Successful trading must be indicator-based.

- Misconception #2: Successful trading must be complex.

Before we dive into why these beliefs are absolutely wrong, it would serve us well to have a look at the “Forex” industry as it stands today.

With the inception of the internet, came the online trading phenomenon, allowing anyone with an internet connection to trade anywhere in the world. The benefit of online trading of course is that it gives the trader easy access to trade the financial markets.

BUT…

This freedom to trade with the push of a button anytime/anywhere also comes with many disadvantages.

The result of the online trading phenomenon has created a modern version of the “Snake Oil” salesmen, resulting in an ever-increasing number of “instant experts”, “trading gurus” who, with trading alerts, systems and clever online marketing, promise returns that will lead to instant wealth.

Most of the information available in the “Forex Space” fails to provide any actionable knowledge whatsoever.

What is available from these “Snake Oil” merchants is a quick and simple solution to the 3 misconceptions about successful trading that for a low investment will make all your trading issues disappear and you are going to get rich.

YEAH RIGHT!!!

They feed off your expectations, which for most new traders are completely unrealistic.

However, if you are reading this, you know that most of the internet is full of worthless crap and you genuinely want to improve your skills by accessing the real-world actionable knowledge.

Congratulations, you are in the right place!

Misconception #1: Successful trading must be indicator-based

There are many ways to profit in forex, some of them do involve indicators, but indicators ARE NOT necessary for successful trading.

There are many professional traders around the globe, including a couple of my friends, who simply use a NAKED chart (more on this later) to make their trading decisions.

Indicators quite often delay a trader’s progression because the focus is on the indicator, rather than on “price action”.

Many traders blame the indicator for losing streaks, and this reliance on indicators often keeps traders in a holding pattern.

When starting out, many traders focus on the indicator or indicators.

This is completely understandable since nearly 90% of all forex information (forex sites, webinars, seminars) focus on indicators and indicator-based trading.

The problem with this is indicators encourage “secondary thinking” which is a major handicap for traders looking to acquire expertise.

Secondary thinking involves analyzing the indicator, spending unnecessary time considering where the indicator may go, rather than focusing on the only thing that matters – PRICE.

Naked traders by definition focus on price (on the movement of the market) which is vastly different.

It is much easier for the new or novice trader to begin trading WITHOUT indicators.

#1. Avoid Being a Trading Tragic

All indicators regardless of the indicator are a derivative of price.

That is to say, all indicators are created from price data, price data is entered into an equation or formula and outputs the end product, be it a squiggly line, straight line, a number or a color, the end result is always the same.

Whilst the form this result takes (the indicator) the process is always the same.

The goal of these indicators is of course supposed to help the trader when to enter and when to exit the market, and of course these indicator systems are marketed as an easier way to determine the current and future track of the market.

All indicator-based trading systems are founded on the concept that price data is in a better form when represented by an indicator than reading raw PRICE ACTION.

Every trader wants to know where price will go in the future and globally millions and millions of dollars are spent every year and the great HOPE for most traders is that there is a valuable indicator or recipe of indicators working together that will hint at where the market is headed in the future.

Even if there was such an indicator based upon some magical formula (unfortunately there isn’t), there are still difficulties with indicator-based trading.

#2. Indicator Lag

Significant moves in the forex market occur BEFORE a technical indicator provides a signal.

Indicators are inherently slow. The market will be moving up long before an indicator suggests it’s time to buy, likewise an indicator will suggest it’s time to sell long after the market started falling.

This is one of the main complaints regarding indicators: they ALWAYS lag behind price.

Indicators may certainly alert the trader the market has turned around after the market has turned around.

#3. Indicators Create Unnecessary Draw Downs

Most traders accept that severe drawdowns are simply a part of trading.

This is simply NOT TRUE.

Severe drawdowns are characteristic of mistimed entries.

And most traders use indicators to find entry signals, so most traders mistime entries. All traders experience drawdowns. All traders experience losing trades, however indicator-based traders often blame their indicators for unsuccessful trades.

When something doesn’t go right, they often change indicators or change the setting on the indicator they are using.

Rather than the indicator trader taking responsibility for losing trades, they use the indicator as their scapegoat when things go wrong, so in the trader’s mind having the indicator to blame is an advantage for them because that last losing trade wasn’t their fault.

#4. Trading Without Indicators is Liberating

By adopting a Naked Trading approach means letting go of a trade.

There are no indicators to give you false signals, there is no one else or no one thing to blame for the lost trade or series of trades, there are no settings to tweak.

There is simply the market price and the trading decision. There is no better indicator of the sentiment, attitude or exuberance of the market than the current market price

The current market price is the BEST indicator of the future track of the market.

Misconception #2: Successful trading must be complex

Trading in itself is an inherently simple thing to do. That doesn’t mean it is easy, however at a fundamental level trading is simple.

And it’s this simplicity that creates a great paradox for many traders.

Humans in general (not just traders) inherently believe, to be successful at something, you need a lot of knowledge or in a trader’s case a lot of data. We seem to think that things must be complicated, and our ability to make the complicated uncomplicated is our key to success.

Nothing could be further from the truth. The most successful traders on the face of the earth keep their trading incredibly simple.

In my early days I made my trading far more complex and confusing than it needed to be. It wasn’t until I had enough of “going nowhere” and decided to strip back my trading, get rid of indicators, and learn how to read price action, that was truly the day my trading turned around.

Once I realized that the only thing that mattered was PRICE. Once I realized that price is KING, nothing else mattered. Your first step to success as a trader is completely dependent on only one thing.

You only have to pay attention and focus on one single thing, and that is: PRICE.

Price will tell you everything you need to know. All you have to do is to learn how to read the price action of a chart. Now fortunately this is not a difficult thing to do.

Yes, it will take you some time to develop your skills, however the rewards for knowing how to read price action will pay you dividends for the rest of your life.

Whilst this is not a lesson on how to read price action, here are 5 points to simply your trading:

#1. Tidy your charts up

- Remove everything on your charts that prevents you or distracts you from seeing the price movement on your charts.

- Set your charts up so all you have are the candlesticks on your charts and nothing else.

- Make sure the colors you use can easily distinguish between the bullish and bearish candles (me I use a simple plain black and white vanilla chart).

The point is it doesn't matter what colors you use, just make sure they are easy on the eye, and you can get a clear picture of price movement.

The most important point is DO NOT overlay your charts with unnecessary crap.

In short, we are looking to go from something that looks like this:

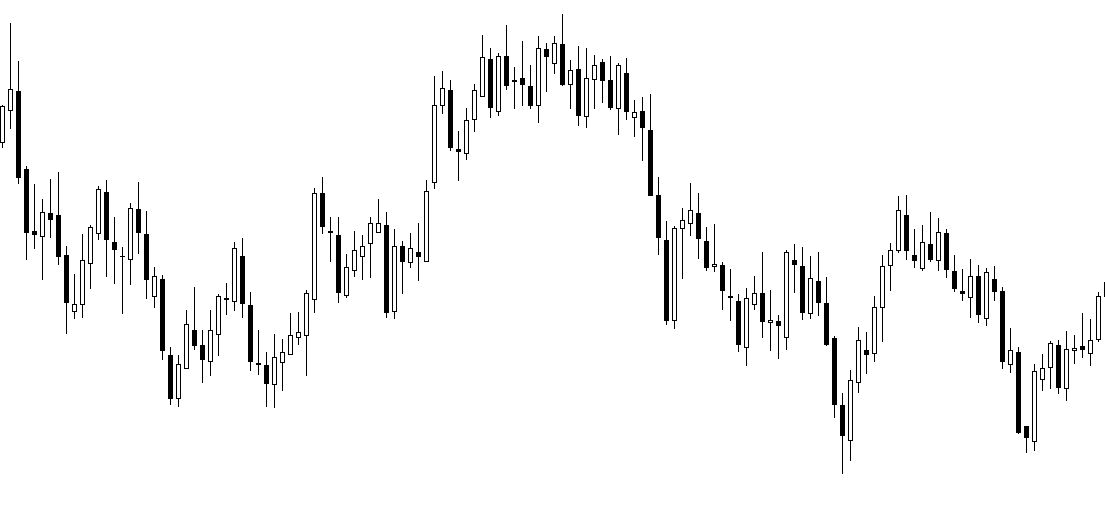

To something like this.

You might think the first image is an exaggeration, however I have seen traders who have charts not too dissimilar to this.

Out of the two charts, which do you think is easier to work with?

So, the very first thing to do is get rid of stuff cluttering up your charts.

#2. Move to the higher time frames

Move away from the noise of the market. Begin to read price action on the higher time frames. (For me the daily time frame is the sweet spot). The higher the time frames the more reliable the price action, as the higher time frames filter out all the unnecessary noise, made up of the normal market fluctuations.

#3. Identify what the market is doing?

Is the market trending up, down or sideways?

#4. Where are the KEY event areas on the chart?

- The wonderful thing that all markets have in common is – HISTORY. The market will tell you where the key event areas on your chart are and these key event areas are the foundation that profitable price action trading is built on.

- These key event areas are represented by support and resistance zones.

#5. Wait for a price action buy or sell signal to form at these key event areas

Again, this is an area where a lot of traders make things overly complex. Most new traders and some not so new traders make the mistake of thinking they need to know every single price action signal.

This is not necessary, and it is a mistake to think you need to know every signal known to man.

All this does is create confusion when you look at your charts, because you think you are seeing a signal at an event area, you decide to enter the market, only to find you get stopped out a lot.

This is because you are being a “trading generalist” meaning you know a little about a lot of signals, when in fact the opposite is true. Naked traders know “everything” about a handful of signals.

If you wish to improve your results then you should pick one signal, just one signal only and learn what that signal means.

- Is it a trend continuation signal?

- Is it a rejection signal?

- What does this signal tell you about the current bias of the market?

- What does it mean when this signal forms given the context of the market? learn how to trade this one signal. (Where do you enter, where do you place your stop loss).

- Only when you have traded this signal over a large enough sample of trades and have proven this signal plays out in your favor more often than not, only then do you add another signal to your arsenal.

By doing this you are becoming a “specialist” and moving away from being a generalist because you think you need to know a lot of stuff.

You Don’t.

Now I know that a lot of traders won’t do this, because it requires a lot of patience and discipline to ONLY TRADE one signal until you have mastered it, because your signal is not going to show up every day.

So, the undisciplined trader will look for another signal to “master” because the first one is too slow, it’s too boring, there is not enough action and so on.

DON’T BE THAT TRADER.

At the end of the day all you ever need is a handful of signals and a handful of patterns that you know intimately.

I only trade 3 signals and 3 patterns that’s it, but I started by mastering one at a time.

Was it boring?

Yep.

Did I care?

Nope.

Because I knew that the specialists end up taking the money from the generalists and it will always be that way.

In conclusion:

Naked trading simply means to strip everything back to the only thing that matters “Reading Raw Price Data”

It means keeping everything you do Simple.

The benefits of taking a stripped back approach to your trading are enormous.

- It is far less stressful, because Naked traders have clarity, they know exactly what to do and when to do it.

- You will make more money. By trading off a clean naked chart, (where you can read the price action of the market) makes your decision-making process so much simpler, you will end up only taking high probability trades because you can clearly identify when your signal has presented itself at a key event area.

- More time to do other things – this is very important. Naked traders are patient traders, they do not sit and watch their charts for hours on end every day. They know what they are looking for, if it’s there they enter the market, if it’s not they walk away, that’s the trading day over.

I could write volumes on why you should adopt a very simple approach to your trading however suffice to say if you implement the 5 points listed above and stick with it, over time you will begin to develop a far more relaxed attitude towards your trading and your trading results will be dramatically improved.

Hope you are understanding the forex market better with my tactical trading tips, I’ll see you next Friday.

Till then, keep trading and have a wonderful weekend!

Apart from these tactical trading tips, there are 2 more ways I can help you:

- Beginners Fast Track to Forex Domination: If you are a beginner, looking to learn forex trade from scratch to have a massive source of income, I have just the perfect course for you: Enroll in the course now!

- The King of Forex Monthly Membership: If you are further in your journey but struggling with your trades, simply copy my exact setups, watch me breakdown trade analysis each week, learn from my own training modules and chat with me LIVE every month! Join 1000+ traders on an upward trading journey!